The Transformation of Workforce Engagement Management

By Donna Fluss

View this article on the publisher’s website.

Last year was an excellent one for sales of workforce optimization/workforce engagement management (WFO/WEM)-related systems and applications. This positioned vendors to invest heavily in their solutions (particularly during the first six months of the year) and deliver a great deal of innovation to the market. The investments are primarily in the following categories: artificial intelligence (AI), automation, analytics, and user interface/user experience (UI/UX).

What makes these enhancements compelling is that the vendors have taken into account both the need for new capabilities and the importance of making them easy to use. As these new features are being delivered from the cloud, they are getting into the hands of users more rapidly, which allows vendors to monetize them quickly. The cloud is a game changer for both companies and vendors due to its proven benefits for both groups.

ARTIFICIAL INTELLIGENCE MAKES A DIFFERENCE

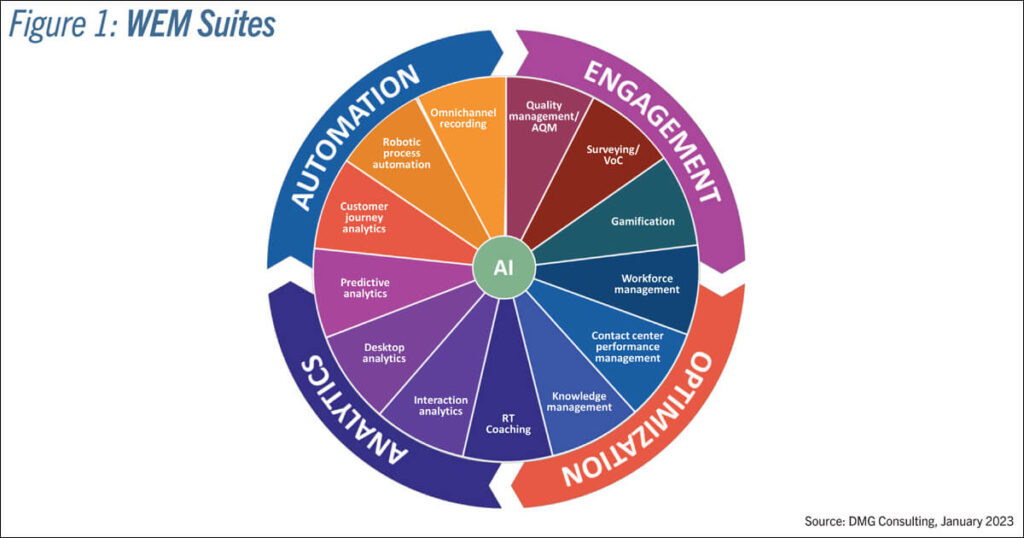

Artificial intelligence has found its way into all of the applications that comprise WFO/WEM suites, greatly enhancing the capabilities of these solutions. But these enhancements are a mere precursor of what will become a major rewrite of most of the 13 applications that make up these suites (see Figure 1). AI has gone from a system add-on to a foundational component of many applications in a WEM suite. Workforce management, interaction analytics, analytics-enabled quality management, surveying, coaching, customer journey analytics, and more are either built on AI technology or depend on it to provide increasingly useful and actionable findings and intelligence for users. As effective as AI is today, we are just seeing the beginning of its potential uses and benefits.

PARTNERSHIPS ARE KEY

Last year saw WFO/WEM providers take advantage of an emerging partnership model. While some of the contact center-as-a-service (CCaaS) vendors sell their own WFO/WEM solutions and capabilities, most sell these applications through partnerships. In some cases, it’s an original equipment manufacturer (OEM) arrangement where a CCaaS vendor white-labels third-party applications and brands them as its own. In other instances, a CCaaS provider brings a WFO/WEM vendor into a deal to deliver functionality that it does not offer. DMG Consulting expects to see the partnership model expand in calendar year 2023, as it is highly beneficial for CCaaS and WFO/WEM vendors as well as for end users who want to purchase their contact center solutions from one provider.

EXPANDING THE BENEFITS OF WFO/WEM APPLICATIONS BY OPENING THEM UP

WFO/WEM providers are investing heavily in making their solutions more open and easier to integrate. This is in large part a response to their enterprise customers who have been asking these vendors for years to open up their solutions so that they could interoperate with other systems and applications, particularly CRM solutions. This trend will prove to be highly beneficial for WFO/WEM vendors, as it will position their solutions to be more easily implemented in contact centers and customer service organizations. It will also make it easier to apply solutions such as workforce management, interaction analytics, gamification, and so on to other company functions (besides contact centers) where there is a great need to enhance both the customer and employee experience. The market is at a pivotal point, and the new wave of enhancements and innovations will help convert these suites into WEM platforms that provide enterprise-wide benefits.

THE ENTERPRISE NEED FOR WFO/WEM CAPABILITIES IS GROWING

Companies are struggling to deliver a service experience that satisfies their customers. They have invested heavily during the past few years in new systems and applications, but many companies seem to be falling behind in their digital transformations. Few contact centers are able to dedicate adequate resources to monitor and evaluate how their agents handle digital interactions, leaving them with little insight into customer satisfaction in these essential and growing channels. Even fewer are applying interaction analytics to their digital channels, further limiting their access to highly valuable information: what their customers are saying about them and the service experience. The growing need to capture customer insights in digital channels represents a tremendous opportunity, but WFO/WEM vendors need to up their game and figure out how to convince companies to apply their solutions in these areas.

MARKET CHALLENGES

While the outlook for the WFO/WEM market appears strong in both the short and long term, it’s not without challenges. Because of the complexity of contact centers, the applications sold by these providers are needed more today than ever before. But market dynamics, driven by the cloud, have changed how companies source these solutions. DMG Consulting research shows that approximately 50 percent to 60 percent of the WFO/WEM applications acquired by contact centers are sold through CCaaS vendors. This sales model presents both benefits and challenges for WFO/WEM suite vendors. On the positive side, it is expanding market opportunity, as these solutions are being sold by dozens of third-party providers. The downside is that it could limit WFO/WEM vendors’ direct access to enterprise buyers and reduce their sales margins.

An interesting test for the established WFO/WEM suite providers is the market entry of many new competitors during the past few years. DMG has seen at least 10 vendors come to market with new quality management and analytics-enabled quality management applications, as well as updated versions of some of the other WFO/WEM modules, with the intent of giving enterprises of all sizes (but particularly small and midsize contact centers) “right-sized” choices. We’re also seeing a new wave of workforce management and speech analytics vendors that are hoping to open up the market by giving companies different options. While the deals being won by these new competitors are still small, some of the emerging solutions are disruptive, and companies are taking note.

FINAL THOUGHTS

The headwinds are strong for IT investments, as the economy appears to be slowing down. This will impact the WFO/WEM market, although this sector is expected to outperform most of the other contact center IT sectors because many of the applications that comprise these suites improve productivity and reduce operating costs while enhancing both the customer and employee experience. Helping this market along will be the tailwinds pushing large enterprises to migrate from their premises-based automatic call distributors and dialers to the cloud.